How Much House Can I Afford? The Ultimate 2025 Homebuyer’s Guide

Navigating the path to homeownership is one of life’s most significant financial milestones. The first step for any aspiring buyer is answering a pivotal question: How much house can I afford? In 2025, this calculation is more important than ever, with mortgage rates higher than preceding years and regional differences now even more pronounced. This comprehensive guide demystifies affordability, breaks it down by income and region, and provides you with actionable steps, tools, advice, and real-life examples to empower your home search.

Why Knowing Your Budget Is the Key to Successful Homeownership

Before jumping into home listings, tours, or closings, it’s vital to understand your budget. This isn’t just a math exercise—it’s the foundation of your home search, protecting your financial health and giving you negotiating power. When you know how much house you can afford, you avoid disappointment, reduce stress, and position yourself for responsible ownership. You’ll be able to say yes to homes that fit your lifestyle and future plans, and confidently walk away from deals that could stretch your wallet.

2025 Housing Trends: What’s Different This Year?

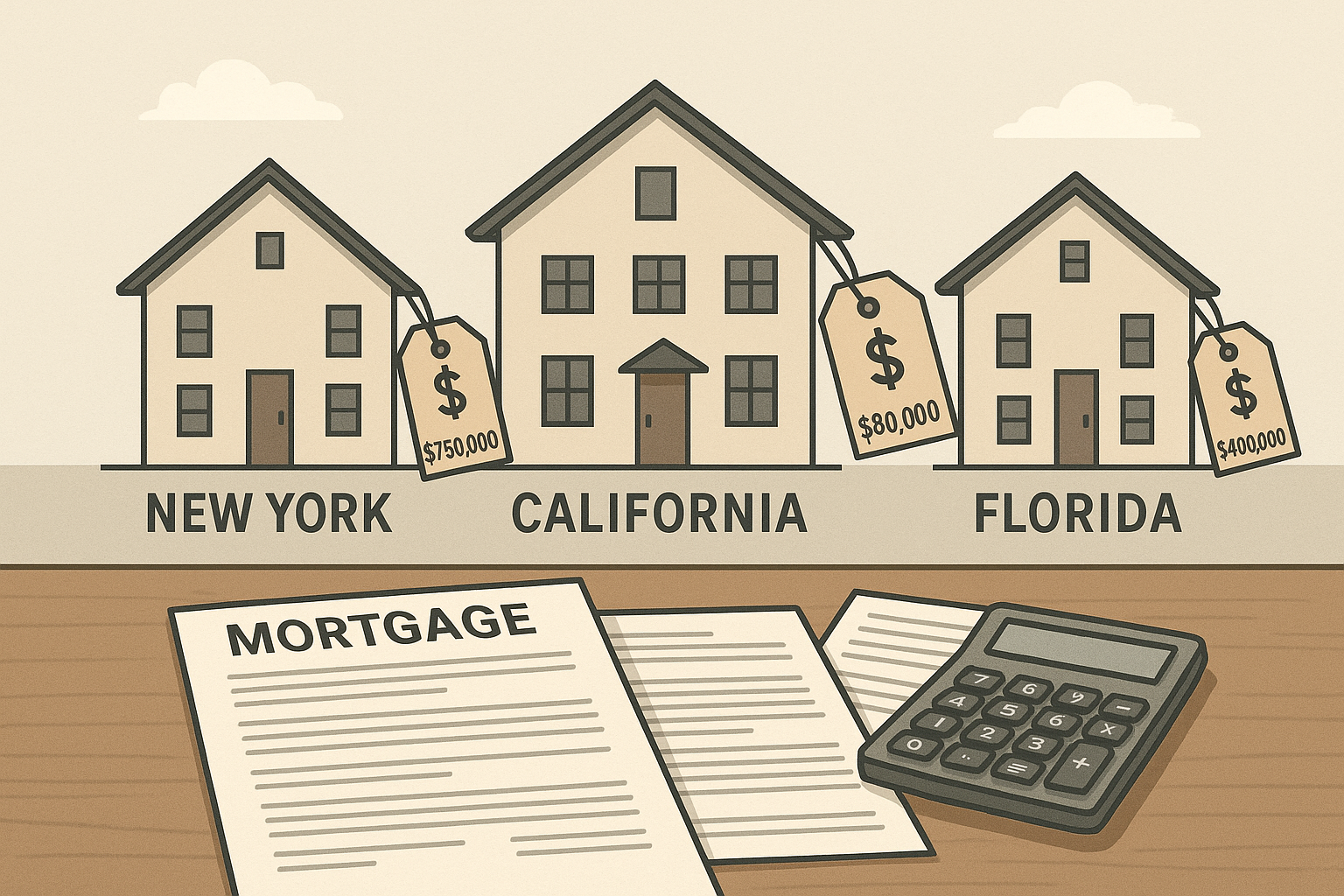

The housing market has always been dynamic, but 2025 stands out for its elevated mortgage rates and sharper regional variations. The average 30-year fixed mortgage rate now hovers around 6.5%, ending a long period of ultra-low borrowing costs. Buyers in all regions of the United States, especially states like New York, California, and Florida, are feeling the effects in their monthly payments. Lenders are scrutinizing debt-to-income ratios more closely and may require higher down payments than in the past. Inventory varies widely, with some areas seeing tight competition and others presenting more choices.

Lender Criteria: Understanding the 28/36 Rule

Most lenders rely on the “28/36 Rule” to determine what you can afford:

- No more than 28% of your gross monthly income should go to housing costs (mortgage, taxes, and insurance).

- No more than 36% should go to all monthly debts, including the mortgage plus credit cards, car payments, and student loans.

Let’s break that down with a practical example. Suppose your household brings in $8,000 per month before taxes. Using the 28% guideline, your maximum allowed housing expense is $2,240. The 36% rule means your total debt payments—including all loans—should stay under $2,880. Lenders use these thresholds to make lending decisions and help protect buyers from overextending themselves.

Calculating Debt-to-Income Ratio (DTI)

Your DTI is crucial for mortgage approval. It’s calculated by dividing your total monthly debt payments by your gross monthly income. Lenders typically want to see a DTI of 36–43% or lower. A high DTI can limit the size of the mortgage you will qualify for, no matter your income level.

Down Payments and Your Buying Power

The conventional 20% down payment is often recommended for the best mortgage terms and to avoid paying private mortgage insurance (PMI). However, there are programs that allow lower down payments, especially for first-time homebuyers. The size of your down payment directly impacts not just your monthly payments but can also open doors to better homes and easier approvals.

Regional Insights: Home Affordability in New York, California, and Florida

New York: High Real Estate Values and Taxes

New York is known for its robust property values, especially in metropolitan areas. Urban condos and suburban houses come with higher property taxes and higher prices.

- Typical median home price: $600,000

- Property tax rate: About 1.7% per year

- Recommended minimum income: $100,000–$120,000 per year, with additional savings for taxes and insurance

- Example payment: A $480,000 mortgage at 6.5% with $120,000 down equals a principal and interest payment of about $3,038, plus $500–$800 for taxes and insurance

California: High Demand, High Prices

California’s market is one of the most expensive in the country, particularly in regions such as Los Angeles, San Francisco, and San Diego.

- Typical median home price: $735,000

- Property tax rate: About 1.16% annually, with variation by county

- Recommended minimum income: $120,000–$140,000 or higher for most buyers

- Example payment: With a $147,000 down payment, a $588,000 mortgage at 6.5% gives a principal and interest payment of about $3,722, plus $650–$900 for taxes and insurance

Florida: More Affordable, But With Risk Factors

Florida’s median prices are easier to manage, but insurance costs are higher due to coastal risks such as hurricanes.

- Typical median home price: $410,000

- Property tax rate: About 0.83%

- Homeowners insurance: Typically $300/month or more

- Recommended minimum income: $80,000 per year for homes up to $400,000 with moderate down payments

- Example payment: A $369,000 mortgage with $41,000 down at 6.5% equals around $2,333 monthly, plus $300 for taxes and $300–$400 for insurance

Step-by-Step Guide: How To Calculate Your Affordability

1. Evaluate Your Total Income

Include every source—salary, regular bonuses, commissions, or side hustles that you can count on.

2. List All Monthly Debts

Gather all your loan payments, credit cards, auto loans, student loans, and any alimony or child support.

3. Determine Your Down Payment

The more you put down upfront, the more home you can afford, and the less your monthly payments will be.

4. Factor in Today’s Mortgage Rates

Use the current 30-year fixed rate, which is around 6.5% in 2025 for calculations.

5. Include Local Taxes and Insurance

These can vary dramatically by location. Research average property taxes and typical insurance costs specific to your target state and region.

Sample Calculation

Let’s say you have:

- Income: $100,000 per year ($8,333 per month)

- Debts: $700 per month

- Home price target: $600,000

- Down payment: $120,000 (20%)

- Loan amount: $480,000

- Mortgage rate: 6.5%

Calculate your monthly payment using the standard formula:Mortgage Payment=Loan Amount×Rate/121−(1+Rate/12)−360MortgagePayment=1−(1+Rate/12)−360LoanAmount×Rate/12

Plug in your numbers to get a monthly payment of about $3,038 for principal and interest. Add $500–$800 for taxes and insurance, and your total monthly obligation lands close to $3,538–$3,838.

Income Scenarios: What Different Salaries Mean For Buyers

Example 1: Lower Income ($50,000 per year)

First-time buyers often work with modest salaries:

- Down payment: 3–5% for FHA loan options

- Home price: $200,000–$250,000 range

- Estimated payment: Principal and interest about $1,264 plus taxes and insurance

Example 2: Middle Income ($80,000 per year)

Perfect for starter homes or condos:

- Down payment: 10–20%

- Home price: $350,000–$400,000

- Estimated payment: Principal and interest roughly $2,025 plus taxes and insurance

Example 3: High Income ($150,000–$200,000 per year)

Enables buyers to afford homes in competitive urban markets:

- Down payment: 20% or more

- Home price: $700,000 and above

- Estimated payment: $4,050 or more, plus higher taxes

Real-Life Success Stories To Learn From

Jenny, a nurse in Buffalo, New York, earned $85,000 last year and wanted a three-bedroom home. With $40,000 saved for the down payment, she targeted houses around $300,000. Her bank approved a $260,000 mortgage at a 6.5% rate. Factoring in taxes and insurance, her total monthly costs were about $2,050. Jenny’s success came from realistic budgeting, a responsible down payment, and careful attention to county property taxes.

Mark, a consultant in San Francisco, earned $190,000 and looked for upscale properties. He could qualify for homes over $1.1 million, but chose a $900,000 condo, putting down $300,000 to keep payments manageable. This decision kept his total housing expenses within the 28% recommendation.

Anna and Luis, a Florida couple with a $60,000 combined income, found a $360,000 home with 5% down. They selected a property outside hurricane-prone zones to save on insurance and prioritized windstorm coverage to protect their investment.

Using Online Home Affordability Calculators

Modern calculators allow buyers to compare scenarios instantly, adjusting for income, down payment, mortgage rates, taxes, and insurance. Look for calculators that ask about PMI, allow location-specific adjustments, and include interactive sliders for principal, rate, and term. Double-check results with your lender for accuracy and any additional fees.

How Your Credit Score Affects Mortgage Approval

A strong credit score opens the door to the lowest available rates and the largest possible loans. Scores above 760 typically secure prime rates and terms, while scores below 650 can increase both your rate and your monthly payment, cutting available homes out of your search. Improving your score before home shopping pays off in a bigger budget and lower costs.

Monthly Rate Fluctuations: Timing Matters

A single point change in mortgage rates, such as from 5.5% to 6.5%, can change your monthly payment on a $400,000 mortgage by more than $250. Over the course of your loan, this could mean thousands of dollars saved or spent. Staying alert to rate changes and locking in a rate at the right moment can give you more buying power and protect your budget.

Don’t Forget Escrow and Closing Costs

Beyond your monthly payment, factor in 2–5% of the home price for closing expenses. These costs include lender fees, taxes, title, insurance, and any prepaid interest. For a $600,000 purchase, closing costs may amount to $12,000–$30,000. Prepare early to avoid surprises.

Regional Comparison Table: State Specific Affordability

| State | Median Price | Typical Taxes | Avg. Insurance | Down Payment | Loan Amount | Estimated Monthly Payment |

|---|---|---|---|---|---|---|

| New York | $600,000 | $10,200 | $6,000 | $120,000 | $480,000 | $3,538 |

| California | $735,000 | $8,536 | $7,800 | $147,000 | $588,000 | $4,372 |

| Florida | $410,000 | $3,403 | $4,200 | $41,000 | $369,000 | $2,933 |

Monthly payment estimates include principal, interest, property taxes, and insurance, and may vary with exact location and lender terms.

Frequently Asked Questions

Q: What income do I need for a $500,000 house in California?

A household income of at least $95,000–$110,000 is recommended for comfort, assuming 20% down and moderate debts.

Q: How do property taxes affect affordability in New York?

High taxes, typically 1.7% or above, can add hundreds of dollars a month to your housing payment. Always verify rates by county and plug them into your monthly budget.

Q: Will I pay PMI with less than 20% down?

Yes, PMI can be $75–$150 monthly depending on loan size and lender policies and usually drops off once you build 20% equity.

Q: What other costs will I face after buying?

Expect moving costs, ongoing repairs, possible association or HOA fees, and higher utility bills compared to renting. Build a cushion into your monthly budget.

Buying Investment Properties, Condos, and Rural Homes

Secondary homes and investment properties bring additional requirements. Expect lenders to ask for higher down payments (often 25%) and raise interest rates. Condos in urban settings may require monthly HOA fees; include these in your housing calculations. Rural buyers should check for well water or septic fees, which can impact costs.

Expert Strategies to Maximize Your Home-Buying Budget

- Compare mortgage quotes from several lenders; even a slight difference in rates can save thousands over your loan’s life.

- Save up for a higher down payment to lower monthly payments and skip PMI.

- Pay down debts before applying; reducing your DTI raises your available budget.

- Consider co-buying with a spouse, partner, or trusted relative to combine incomes and qualify for a larger loan.

- Ask about grants, assistance programs, and first-time buyer incentives specific to your state.

SEO Best Practices for Home Affordability Blog Posts

Boost your ranking by applying these tips:

- Place the main keyword (“how much house can I afford”) in your title, headers, and early paragraphs.

- Use long-tail variants such as “affordability calculator for New York” or “calculate home budget in California.”

- Add a FAQ section with direct, common buyer questions.

- Include a visually clear, data-rich comparison table.

- Repeat core keywords every 300–400 words in an organic, helpful way.

- Bold essential terms to aid readability and scan-ability.

Conclusion: Building Confidence and Clarity in Your Home Search

A clear understanding of affordability sets you up for a smart, enjoyable home-buying journey. By carefully calculating your budget, knowing your region’s prices and taxes, using accurate calculators, and partnering with the right lender, “how much house can I afford” becomes an empowering question—not a stressful hurdle.

Ready for next steps or a personalized affordability analysis? Yesloanz.com welcomes buyers at all stages. Let us guide you through current rates, state-specific programs, or connect you with expert lenders to turn your home dreams into reality.